With that said, it is important that you calculate the annual turnover ratio of the mutual fund or ETF before making any decision. For example, brokerage fees and other additional costs could affect the turnover ratio significantly. The calculation is also important to establish the additional cost the investor might incur over the course of the investment. Of course, you are going to want to invest in Mutual Funds that are actively managed as there is a high chance they can bring good returns on investment. range in which most fund ratios lie (0 to 2. That’s because only the turnover ratio can tell you whether the funds you are Investing in are actively or passively managed. Morningstar and excess return Sharpe ratios Clearly, the two measures are highly correlated across funds. It is extremely important for the investors to calculate the annual turnover ratio of the exchange-traded funds as well as mutual funds before making any decision.

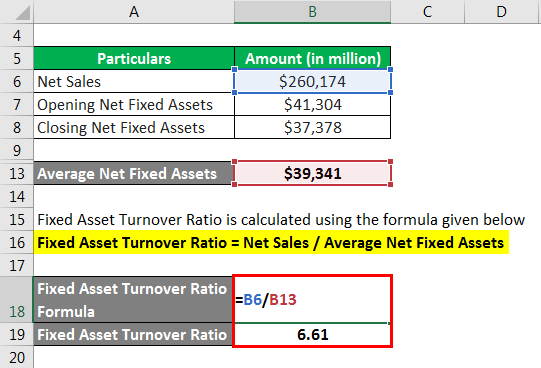

A young woman checks her phone while at her desk at home. Why is the Calculation of Annual Turnover Important? Consider these top brokers if youre looking to invest in mutual funds. In simple terms, the turnover ratio measurement gives you a clear picture of the changes that occurred in the securities trading over the previous year. Now, if you get a 100% annual turnover ratio of a fund, then it indicates that all holdings were traded in the past year. You will get the answer in percentage and it will simply indicate the total securities that have been traded over the course of a year. In order to calculate the turnover ratio of the funds, you are supposed to add the total holdings bought and sold and divide the result with the assets under management. The formula for calculating the annual turnover ratio is as follows:Īnnual Turnover = Securities bought and sold / assets under management And while the number of passive funds has grown faster than that of active funds over. The higher annual turnover ratio indicates an actively managed mutual fund, while the low ratio suggests that the funds are being passively managed. Correspondingly, active funds’ 10-year lineup turnover ratio was 16.2 compared with passive funds’ 15.3. It is important to note that every time the mutual fund purchases or sells, the annual turnover of the company will grow. It tells us the securities that are being traded within the exchange-traded funds as well as mutual funds Portfolio. If we put it in simple terms, the annual turnover is used to calculate the annual trading activity of investment. In an investment context, the term is used for Mutual Funds and other investment instruments. In a business context, the annual turnover is for inventories, bill payables and Receivables, and fixed assets of the company. What is Annual Turnover? Updated on J, 989 viewsĪnnual turnover ratio is the term used to define the rate at which an investment changes ownership in 12 months. Example of Annual Turnover Ratio in Investment Context.Why is the Calculation of Annual Turnover Important?.

0 kommentar(er)

0 kommentar(er)